Marriage is Marriage: Now, How Do We File Our Income Taxes?

June 26, 2013 The United States Supreme Court ruled in Windsor v. United States that Section 3 of the Defense of Marriage Act was unconstitutional.

June 26, 2013 The United States Supreme Court ruled in Windsor v. United States that Section 3 of the Defense of Marriage Act was unconstitutional.

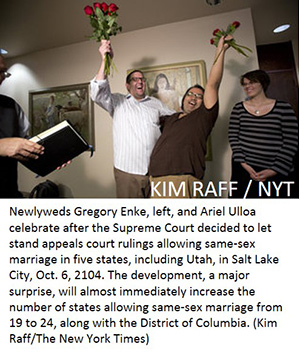

October 6, 2014 The Supreme Court dismissed appeals to overturn same-sex marriage laws in Virginia, Utah, Oklahoma, Indiana and Wisconsin.

Utah CoupleHeadlines in newspapers and media outlets across our nation herald a long awaited, hopefully anticipated, and widely unexpected (at least by timing) decision on the legality of same-sex marriage. While yesterday’s action by SCOTUS only immediately established the foundation for marriages in the 5 states where current appeals had been filed, it is interpreted by most constitutional scholars that the Court is placing this matter in the states hands. It is widely expected that soon, 30 states will have enacted legislation legalizing same-sex marriages.

So, what does the Supreme Court’s rulings have to do with how you file your income tax? Lots.

The Internal Revenue Code (IRC) requires all married couples to file either as Married Filing Separately, Married Filing Jointly, or Head of Household (if certain conditions apply). If you get married in 2014, you no longer can file Single, you must file with an appropriate Married filing status. If you were legally married prior to June 26, 2013, the IRS allows you to file amended tax returns (Form 1040X) if you wish to change your individual filing statuses from Single to Married Filing Jointly for years 2011 and 2012. It may be in your best interest to do so, but not necessarily. You are not required to amend prior years to change from Single to Married, but can if you so wish. Consult a qualified tax professional to determine the best filing status for you and your spouse to use.

Couples may think that Married Filing Separately is the easier way to file, i.e., like continuing to file Single. Not so fast. There are many unfavorable provisions in the Tax Code for couples filing Married Filing Separately. It is highly unlikely that couples using the Married Filing Separately status will pay less combined tax than if they filed Jointly. I amended 2013 returns for a couple last week that resulted in a tax savings of more than $10,000 by filing Married Filing Jointly.

The October 6 dismissal of state appeals before the Supreme Court clears the way for the simplification of tax filing for same sex couples in many states. Up until now, couples in states that did not recognize same-sex marriages were forced to file as Married on their Federal income tax returns and then as Single on their state returns. One would expect that standardization of filing statuses will result as more and more states adopt inclusive marriage definitions.

A toast to all newlyweds. Now consult with your tax professional to understand how your marriage will affect this year’s refund!

Jeff Randall is a Principal Tax Advisor and Financial Coach at Tax Break. jeff.randall@fulcrum6.com