FBAR: Could Skipping 4 Letters Cost You $10,000?

Here’s a quick survey question – do you have a requirement to file FinCEN Form 114 this year? Raise your hand high so I can count. Hmm, it looks like some of you are scratching your head with a puzzled look. What the blazes is a FinCEN Form 114? When you prepare your US income tax return and have interest or dividend income, your tax preparer, tax professional or tax preparation software should prompt you with a question about foreign financial assets. On Schedule B of the 1040 and 1040A there is a question “At any time during 2014 did you have a financial interest in or signature authority over a financial account (such as a bank account, securities account, or brokerage account) located in a foreign country. If yes, are you required to file FinCEN Form 114 Report of Foreign Bank and Financial Accounts (FBAR) to report that financial interest or signature authority? Transparency and cross-border reporting of foreign assets and financial accounts continues to increase each year. Whereas 25 years ago, Americans with off-shore accounts and assets enjoyed relative obscurity when it came to visibility over the ownership and value of their foreign accounts.

Here’s a quick survey question – do you have a requirement to file FinCEN Form 114 this year? Raise your hand high so I can count. Hmm, it looks like some of you are scratching your head with a puzzled look. What the blazes is a FinCEN Form 114? When you prepare your US income tax return and have interest or dividend income, your tax preparer, tax professional or tax preparation software should prompt you with a question about foreign financial assets. On Schedule B of the 1040 and 1040A there is a question “At any time during 2014 did you have a financial interest in or signature authority over a financial account (such as a bank account, securities account, or brokerage account) located in a foreign country. If yes, are you required to file FinCEN Form 114 Report of Foreign Bank and Financial Accounts (FBAR) to report that financial interest or signature authority? Transparency and cross-border reporting of foreign assets and financial accounts continues to increase each year. Whereas 25 years ago, Americans with off-shore accounts and assets enjoyed relative obscurity when it came to visibility over the ownership and value of their foreign accounts.

This is no longer true. The post 9-11 world and numerous economic crises in various countries worldwide have created unprecedented cooperation in the financial world. Now it is not unusual for a foreign bank to request a US citizen provide their tax identification number.

While many Americans successfully navigate their annual income tax return filing, many with the use of off-the shelf or on-line tax preparation software, the arena of tax and reporting of foreign assets and financial accounts adds an often bewildering and confusing dimension. Penalties for not reporting foreign assets can be quite staggering ($10,000, even $100,000). FinCEN Form 114, Report of Foreign Bank and Financial Accounts, also known as FBAR is used to report financial interest or signature authority over a foreign financial account.

The FBAR is a Department of the Treasury, not IRS, report.  The FBAR does not assess tax – it is a reporting document, identifying foreign accounts where a US person has financial interest or signature authority over an account whose value exceeded $10,000 US dollars (USD) at any time in the previous calendar year. The FBAR is filed through the Financial Crimes Enforcement Network’s (FinCEN) BSA E-Filing System and is due by June 30 each year.

The FBAR does not assess tax – it is a reporting document, identifying foreign accounts where a US person has financial interest or signature authority over an account whose value exceeded $10,000 US dollars (USD) at any time in the previous calendar year. The FBAR is filed through the Financial Crimes Enforcement Network’s (FinCEN) BSA E-Filing System and is due by June 30 each year.

Filing FinCEN Form 114, FBAR is required for any US citizen (including children), residents, and entities including corporations, partnerships and LLCs. person with a financial interest or signature authority over foreign financial accounts if the aggregate value of all foreign accounts exceeds $10,000 USD at any time during calendar year. A foreign account for FBAR reporting is a financial account located outside the United States. An account in a foreign branch of a US institution is a foreign account for FBAR reporting purposes. A US branch of a foreign bank is not considered a foreign account for FBAR reporting purposes. For FBAR reporting purposes, a foreign account includes:

- Securities

- Brokerage

- Savings

- Demand

- Checking

- Deposit

- Time deposit

- Commodity futures or options accounts

- Insurance policies with cash value

- Annuity policies with cash value

- Shares in mutual funds

Accounts jointly owned by spouses can be reported on one FBAR if all the accounts of the non-filing spouse are jointly owned and reported on the other spouse’s FBAR and Form 114a, Record of Authorization to Electronically File FBARs is prepared and maintained in the filers’ records.

The FBAR requires reporting of the following information for each foreign account: Maximum value during the calendar past year; Type of Account – bank, Securities, Other; Name of financial institution; Account number; and Financial institution address.

For foreign accounts which a US person has signature authority but no financial interest, the FBAR requires the following information about the account holder: Owner name; Tax identification number of the account holder; Owner mailing address; FBAR filer’s title authorizing signature authority reference the account owner.

So, what happens if you don’t file an FBAR? Penalties for persons required to file a FinCEN 114 and failing to do so may be up to $10,000 per violation. Willful failure to file required account information is subject to a penalty of the greater of $100,000 or 50% of the balance in the subject account at the time of the violation. Willful violations may also be subject to criminal penalties.

FinCEN 114 is due by June 30 each year. There are no extensions to this deadline. The FBAR must be electronically filed using the BSA E-filing System. FBARs are not normally filed by individuals as access to the BSA e-filing system is restricted and it takes some use of the system to be able to navigate it to accurately complete and submit an FBAR.

So the filing deadline for FinCEN 114 is right around the corner, June 30. If you aren’t sure if you answered the questions about foreign accounts correctly on your tax return or if you have a requirement to file an FBAR, send a note to info@taxbreak.tax. Or, get my FREE FinCEN 114 Resource Guide.

Denise committed herself last year to putting God first in her life and began tithing the first of the year. Denise’s tithe totaled $9000 last year and she received a statement at the end of the year from her church acknowledging her giving. She still had her state withhold

Denise committed herself last year to putting God first in her life and began tithing the first of the year. Denise’s tithe totaled $9000 last year and she received a statement at the end of the year from her church acknowledging her giving. She still had her state withhold

Across this great land of ours, thousands of tax practitioners, software developers, IRS and state tax and revenue offices are hard at work studying current Federal, state and local income tax laws to provide taxpayers a smooth filing of their 2014 income tax returns. The IRS has completed their annual road show, spreading the good word and setting the stage for everyone to file according to the law of the land. But wait! Uncertainty is the only sure thing one can count on in today’s world according to Washington. There are 3 looming events that may impact your tax refund this year.

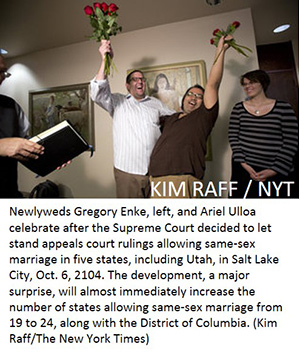

Across this great land of ours, thousands of tax practitioners, software developers, IRS and state tax and revenue offices are hard at work studying current Federal, state and local income tax laws to provide taxpayers a smooth filing of their 2014 income tax returns. The IRS has completed their annual road show, spreading the good word and setting the stage for everyone to file according to the law of the land. But wait! Uncertainty is the only sure thing one can count on in today’s world according to Washington. There are 3 looming events that may impact your tax refund this year. June 26, 2013 The United States Supreme Court ruled in Windsor v. United States that Section 3 of the Defense of Marriage Act was unconstitutional.

June 26, 2013 The United States Supreme Court ruled in Windsor v. United States that Section 3 of the Defense of Marriage Act was unconstitutional. Autumn is starting this week and September 30th marks the end of the 3rd quarter of Calendar Year 2014. Now’s a good time to take a two-minute timeout to both look back at the year so far and look ahead to the 4th Quarter.

Autumn is starting this week and September 30th marks the end of the 3rd quarter of Calendar Year 2014. Now’s a good time to take a two-minute timeout to both look back at the year so far and look ahead to the 4th Quarter. So, are you finding moHand Holding Cash and Credit Cardsre and more that there is more month left than money? Making minimum payments becoming a way of life? Always worried about next month’s bills? Money fights making life difficult with your spouse? You’re not alone. More than 70% of households in the United States are living paycheck to paycheck. You have options to take control of your money and not feel controlled by your money. There are methods proven to be effective in making profound impacts on the lives of millions of people. First – you need to not buy things you don’t have cash to pay for.

So, are you finding moHand Holding Cash and Credit Cardsre and more that there is more month left than money? Making minimum payments becoming a way of life? Always worried about next month’s bills? Money fights making life difficult with your spouse? You’re not alone. More than 70% of households in the United States are living paycheck to paycheck. You have options to take control of your money and not feel controlled by your money. There are methods proven to be effective in making profound impacts on the lives of millions of people. First – you need to not buy things you don’t have cash to pay for.